Passive Income Ideas take the spotlight as we dive into a world of financial freedom and creativity, offering readers a chance to explore diverse avenues of generating income in an ever-evolving landscape.

Get ready to uncover the secrets behind building wealth with minimal effort and maximum returns.

Introduction to Passive Income Ideas

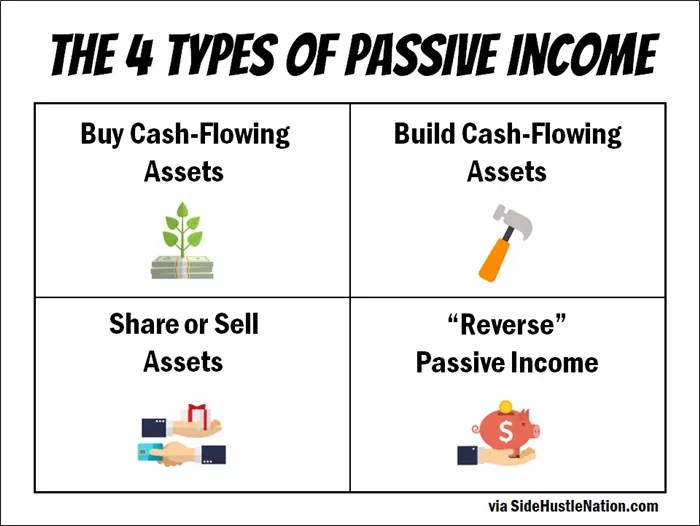

Passive income refers to earnings that require little to no effort to maintain. This type of income allows individuals to generate money without actively working for it, providing financial stability and freedom. The significance of passive income lies in its ability to create multiple streams of revenue, diversifying one’s income sources and reducing financial dependence on a single source.

Benefits of Having Passive Income Streams, Passive Income Ideas

- Financial Independence: Passive income allows individuals to build wealth and achieve financial independence by generating income consistently.

- Flexibility: With passive income streams, individuals have the flexibility to pursue other interests or ventures without worrying about financial constraints.

- Residual Income: Passive income provides the opportunity to earn money continuously, even when not actively working.

- Long-Term Sustainability: Building passive income streams can lead to long-term financial stability and security.

Popular Passive Income Ideas

- Investing in Dividend-Paying Stocks: By investing in dividend-paying stocks, individuals can earn regular income through dividends paid out by the companies.

- Rental Properties: Owning rental properties can generate passive income through rental payments from tenants.

- Creating and Selling Online Courses: Developing online courses and selling them on platforms like Udemy or Teachable can provide a source of passive income.

- Affiliate Marketing: Promoting products or services and earning a commission on sales made through affiliate links is a popular passive income idea.

Real Estate Investment

Investing in real estate can be a lucrative way to generate passive income. By purchasing properties and renting them out, investors can earn regular income without actively working for it. Real estate has the potential for long-term appreciation, allowing investors to build wealth over time.

Ways to Invest in Real Estate for Passive Income

- Buy and Hold Rental Properties: Purchasing residential or commercial properties and renting them out to tenants can provide a steady stream of passive income.

- Real Estate Investment Trusts (REITs): Investing in REITs allows individuals to own shares in real estate portfolios without directly owning physical properties.

- Real Estate Crowdfunding: Participating in real estate crowdfunding platforms enables investors to pool their funds with others to invest in properties.

Tips for Beginners Interested in Real Estate Investment

- Do Your Research: Understand the local real estate market, property values, and rental demand before making any investments.

- Start Small: Begin with a single property or investment option to gain experience before expanding your portfolio.

- Work with Professionals: Seek guidance from real estate agents, property managers, and financial advisors to make informed decisions.

- Consider Financing Options: Explore different financing options such as mortgages, loans, or partnerships to fund your real estate investments.

Stock Market Investments

Investing in stocks can be a lucrative way to generate passive income. By purchasing shares of companies, you can earn dividends and capital gains without having to actively work for it.

Different Investment Strategies

- Dividend Investing: Focus on selecting stocks that pay regular dividends, providing a steady stream of passive income.

- Growth Investing: Invest in companies with high growth potential, aiming for capital appreciation over time.

- Value Investing: Look for undervalued stocks that have the potential to increase in price, generating passive income through capital gains.

Key Factors for Stock Market Investing

- Research and Analysis: Conduct thorough research on the companies you are interested in investing in to make informed decisions.

- Diversification: Spread your investments across different sectors and industries to reduce risk and increase potential returns.

- Risk Management: Understand the risks involved in stock market investing and develop a strategy to mitigate potential losses.

- Long-Term Perspective: Adopt a long-term investment approach to allow your investments to grow over time and generate passive income steadily.

Online Business Ventures: Passive Income Ideas

When it comes to generating passive income, online business ventures can offer a variety of opportunities for financial growth. By leveraging the power of the internet, individuals can create sustainable streams of income with minimal ongoing effort.

Various Online Business Models

There are several online business models that can help you generate passive income:

- Dropshipping: Selling products through an online store without holding inventory.

- Affiliate Marketing: Earning commissions by promoting other companies’ products.

- Print on Demand: Creating custom designs for products that are printed and shipped on-demand.

- Digital Products: Selling e-books, online courses, or software.

Setting Up an Online Business

Setting up an online business for passive income involves:

- Identifying a niche market with high demand.

- Creating a business plan and setting up your online presence (website, social media, etc.).

- Driving traffic to your online business through marketing strategies.

- Implementing systems for automation and scalability.

Scaling Online Businesses

Tips for scaling online businesses to increase passive income:

- Invest in paid advertising to reach a larger audience.

- Expand your product or service offerings to cater to different customer segments.

- Optimize your website for conversions to improve sales and revenue.

- Outsource tasks to free up time for strategic growth planning.

Dividend Investing

Dividend investing is a strategy where investors purchase shares of companies that pay out dividends to their shareholders. These dividends are a portion of the company’s profits distributed to investors on a regular basis, usually quarterly. This method of investing allows individuals to generate passive income without having to actively trade or sell their stocks.

Top Dividend-Paying Stocks

- Company A: Known for consistently increasing dividend payouts over the years.

- Company B: Offers a high dividend yield compared to others in the same industry.

- Company C: Has a solid track record of stable dividend payments even during economic downturns.

Building a Dividend Investment Portfolio

Dividend Reinvestment Plan (DRIP): Allows investors to reinvest their dividends back into purchasing more shares of the company, increasing their holdings over time.

- Diversification: Spread investments across different sectors and industries to reduce risk.

- Research: Conduct thorough research on companies’ financial health, dividend history, and future growth potential.

- Long-Term Approach: Focus on companies with a history of consistent dividend payments and growth rather than short-term gains.

Peer-to-Peer Lending

Peer-to-peer lending is a popular way to generate passive income by acting as a middleman between borrowers and lenders. As an investor, you can lend money to individuals or small businesses through online platforms, earning interest on your investment.

Comparison of Peer-to-Peer Lending Platforms

- Lending Club: One of the largest peer-to-peer lending platforms, offering a variety of loan options and competitive returns.

- Prosper: Another well-known platform with a focus on personal loans, providing opportunities for diversification.

- Upstart: Utilizes artificial intelligence to assess borrower risk, potentially leading to higher returns.

- P2P Credit: Specializes in bad credit loans, catering to a niche market with potentially higher interest rates.

Tips for Mitigating Risks in Peer-to-Peer Lending

- Diversify your investments across multiple borrowers to reduce the impact of default.

- Perform thorough due diligence on borrowers by reviewing their credit history and financial stability.

- Consider investing smaller amounts in each loan to spread out your risk exposure.

- Regularly monitor your investments and reinvest returns to maximize your earnings.

Creating and Selling Digital Products

Creating digital products for passive income involves developing content such as eBooks, online courses, software, or digital artwork that can be sold repeatedly without the need for ongoing effort. These products can generate revenue on autopilot once created and marketed effectively.

Platforms for Selling Digital Products

- Online Marketplaces: Platforms like Amazon Kindle Direct Publishing, Udemy, and Etsy allow creators to sell their digital products to a wide audience.

- Self-Hosted Websites: Setting up your own website with e-commerce capabilities using platforms like Shopify or WooCommerce gives you control over pricing and marketing strategies.

- App Stores: Creating mobile apps or games for iOS or Android platforms can be a profitable way to sell digital products.

Tips for Marketing and Selling Digital Products Effectively

- Identify Your Target Audience: Understand who your ideal customers are and tailor your product and marketing efforts to meet their needs.

- Optimize for Search Engines: Use relevant s and strategies to improve the visibility of your digital products in search results.

- Utilize Social Media: Promote your products on platforms like Instagram, Facebook, and Twitter to reach a larger audience and engage with potential customers.

- Create Compelling Product Descriptions: Clearly communicate the benefits and features of your digital products to entice customers to make a purchase.

- Offer Discounts and Promotions: Running limited-time offers or discounts can incentivize customers to buy your digital products and increase sales.